COMMISSIONED BY: SELLINGANTIQUES.CO.UK AND PUBLISHED ON 1 JULY 2025

COMMISSIONED BY: SELLINGANTIQUES.CO.UK AND PUBLISHED ON 1 JULY 2025

The United Kingdom's antiques market stands at a pivotal juncture, a complex ecosystem shaped by the cross-currents of profound structural change and dynamic cultural shifts. The sector is currently navigating a challenging post-Brexit reality, one that has introduced tangible new costs and administrative frictions, impacting its long-held position as a premier global trading hub. This has created a more competitive and demanding operational environment for dealers, auction houses, and fair organisers alike.

Simultaneously, the market is being invigorated by powerful new consumer trends that are redefining value and desirability. A decisive aesthetic shift towards 20th-century design, driven by the interior design industry and a widespread cultural desire for unique, characterful items over mass-produced goods, is creating new areas of growth and opportunity. The digital revolution, accelerated by the global pandemic, has permanently altered the channels to market, democratising access for buyers and sellers but also fragmenting the trade and challenging traditional business models.

Perhaps the most significant tailwind is the rise of sustainability as a core consumer value. This global movement has repositioned antiques from being mere historical artefacts to being a forward-looking, environmentally conscious choice for a new generation of buyers. This confluence of headwinds and tailwinds defines a market in transition, one where survival and success will depend on adaptability, strategic foresight, and an ability to cater to a new kind of collector.

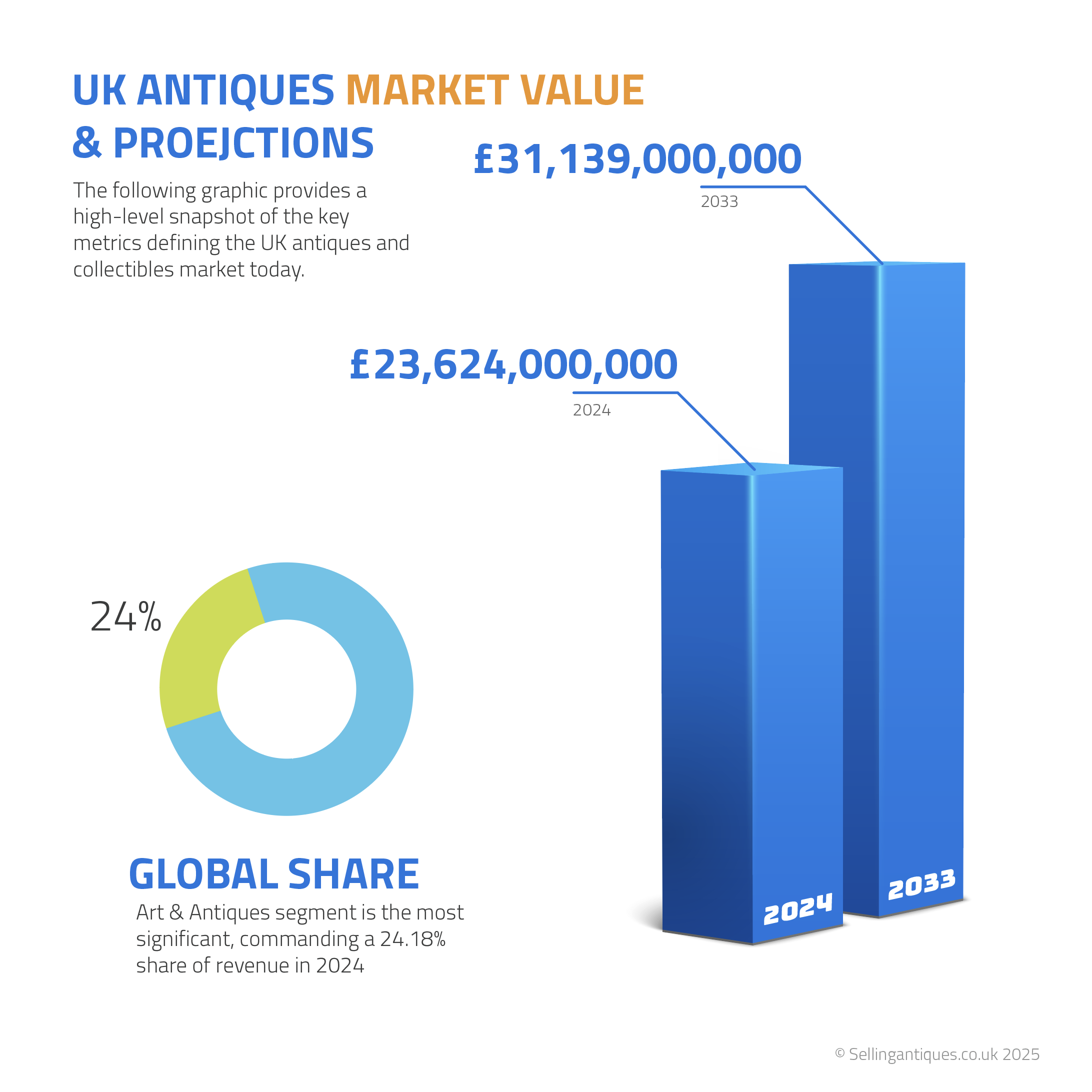

The following dashboard provides a high-level snapshot of the key metrics defining the UK antiques and collectibles market today.

Table 1: UK Antiques & Collectibles Market Dashboard (2024-2030F)

| Metric | Value / Statistic | Source(s) |

| UK Collectibles Market Value (2024) | GBP 23,624.4 million | 1 |

| UK Collectibles Market Forecast (2030) | GBP 31,139.5 million | 1 |

| Projected CAGR (2025-2030) | 4.9% | 1 |

| Art & Antiques Segment Share (2024) | 24.18% of collectibles market | 1 |

| UK Global Art Market Share (2024) | 18% (Rank: 2nd) | 2 |

| Headline Trade Figures (2024) | Exports: £3.72 billion | 3 |

| Imports: £2.3 billion | 3 | |

| Value of Antiques for Sale (Single Platform) | ~£140.8 million (July 2025 data) | 4 |

A thorough understanding of the UK antiques market requires a detailed examination of its financial and economic dimensions. This involves reconciling data from various sources—each using slightly different definitions and scopes—to build a comprehensive picture of the market's value, its standing on the global stage, and its significant contribution to the national economy.

Quantifying the precise value of the UK antiques market is complex, as different reports capture different segments. A broad view is offered by analysis of the "Collectibles" market, which encompasses antiques alongside memorabilia, stamps, and other categories. In 2024, the UK collectibles market was valued at GBP 23.6 billion.1 This market is projected to grow at a compound annual growth rate (CAGR) of

4.9% between 2025 and 2030, reaching a forecasted value of GBP 31.1 billion by 2030.1 It is noteworthy that this growth rate is considerably slower than the projected global collectibles market CAGR of 9.2%, which is estimated to be worth £484.6 billion in 2024, suggesting the UK sector is maturing at a different pace than the worldwide average.5

Within this broad collectibles landscape, the "Art & Antiques" segment is the most significant, commanding a 24.18% share of revenue in 2024.1 This allows for a more focused baseline valuation of the core market at approximately

GBP 5.7 billion for the year. This figure aligns with, yet differs from, valuations provided by art-market-specific reports, which tend to focus on higher-value fine art sales at major auction houses. For instance, the Art Basel and UBS report placed the UK art market value at £10.9 billion in 2023, while the British Art Market Federation (BAMF) reported a value of £11.9 billion in 2022.6 These higher figures reflect the inclusion of high-value contemporary and modern art, which often blurs the lines with the antiques trade but underscores the UK's role in the global art ecosystem.

A distinct and rapidly expanding sub-segment is the online art market. In 2024, this was valued at GBP 724.7 million in the UK and is forecast to grow at a robust CAGR of 6.9% to reach GBP 1.32 billion by 2033.8 This demonstrates that digital channels are a key area of growth, outpacing the projected growth of the overall collectibles market.

The UK's historical importance as a global centre for the art and antiques trade is undeniable. In 2023, it ranked as the second-largest exporter of Arts and Antiques in the world, responsible for 16.1% of all global exports in this category.3 However, its overall share of the global art market has become increasingly volatile, reflecting intense competition and shifting geopolitical dynamics.

After slipping to third place behind China in 2021 with a 17% market share, the UK regained its second-place position in 2022 with an 18% share.7 This was short-lived, as a rebound in the Chinese market saw the UK fall back to third place in 2023, despite maintaining a 17% share.6 More recent 2024 data indicates the UK has once again reclaimed the number two spot with an 18% share, as sales in China contracted significantly.2

This constant reshuffling between second and third position highlights the UK's precarious standing. It remains far behind the dominant global leader, the United States, which consistently commands a 42-45% share of the market.6 The UK is now in a continuous battle with China for the runner-up position, its market share sensitive to economic performance and policy changes in Asia.

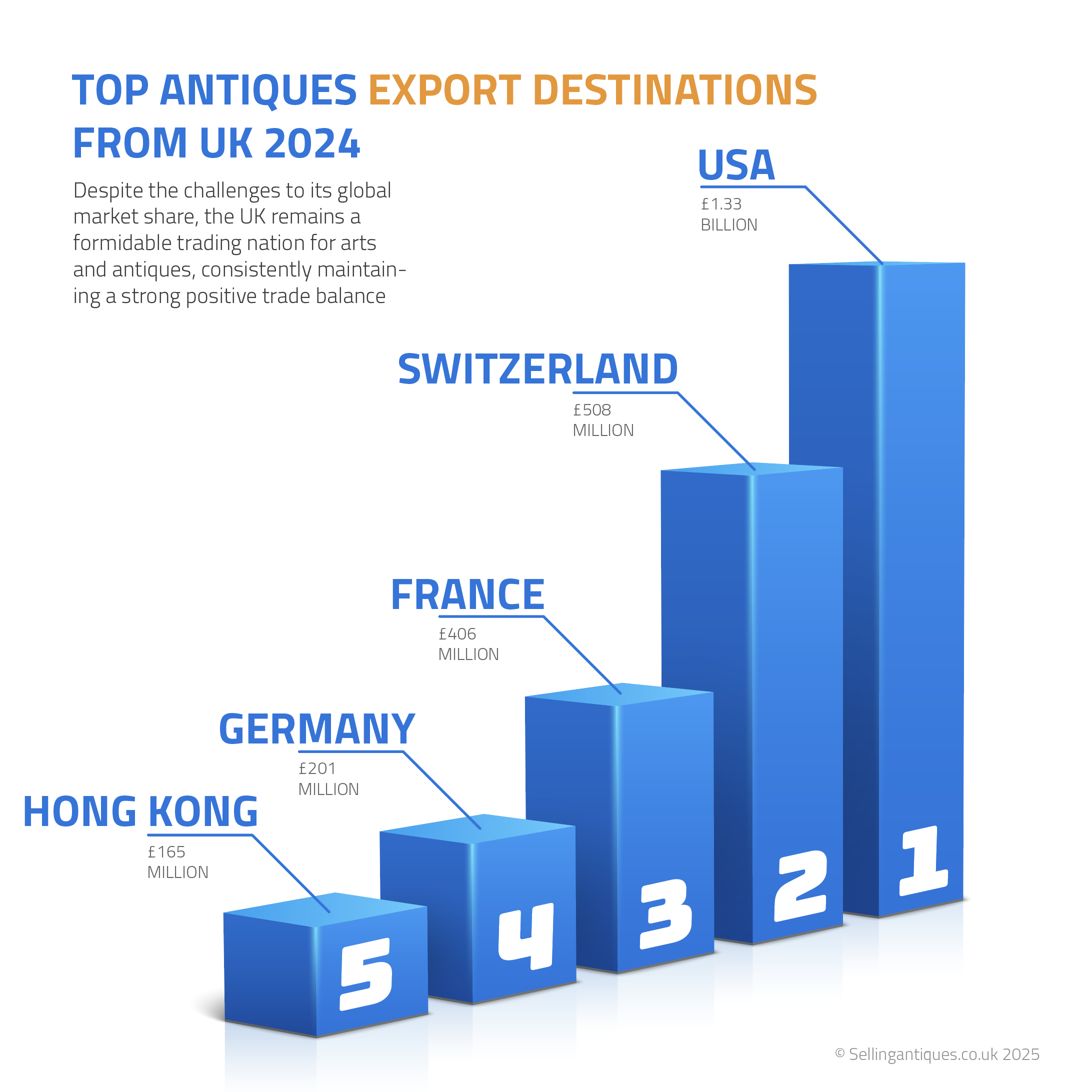

Despite the challenges to its global market share, the UK remains a formidable trading nation for arts and antiques, consistently maintaining a strong positive trade balance. In 2024, the UK recorded exports of £3.72 billion against imports of £2.3 billion, demonstrating its strength as a net exporter of cultural goods.3

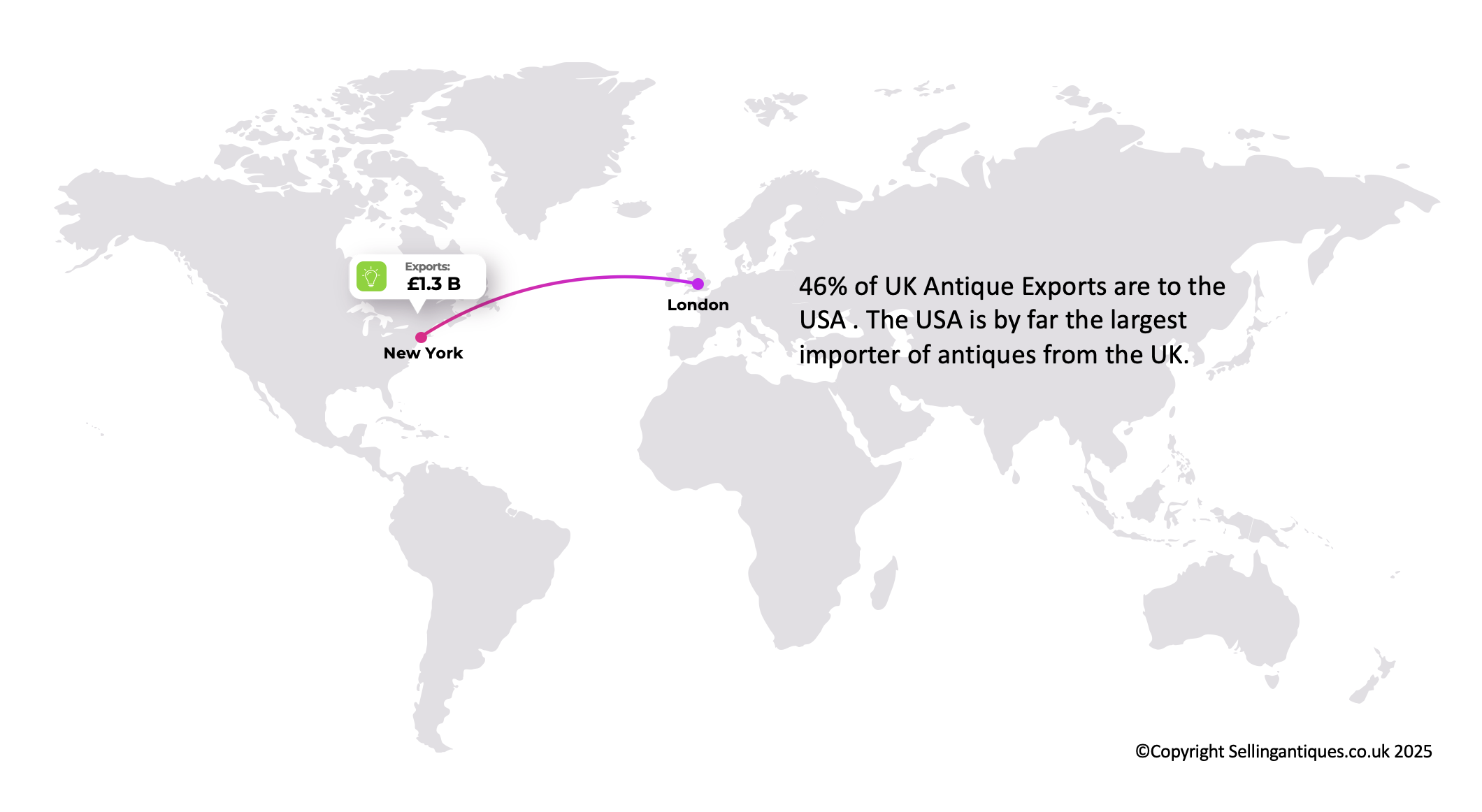

The United States is the market's single most critical trade partner. It is the primary destination for UK exports, valued at £1.33 billion in 2024, and simultaneously the largest source of imports, valued at £888 million.3 This transatlantic relationship is the bedrock of the UK's trade in this sector. Beyond the US, key export markets include Switzerland (£508M), France (£406M), Germany (£201M), and Hong Kong (£165M), highlighting a reliance on established wealth centres in Europe and Asia.3

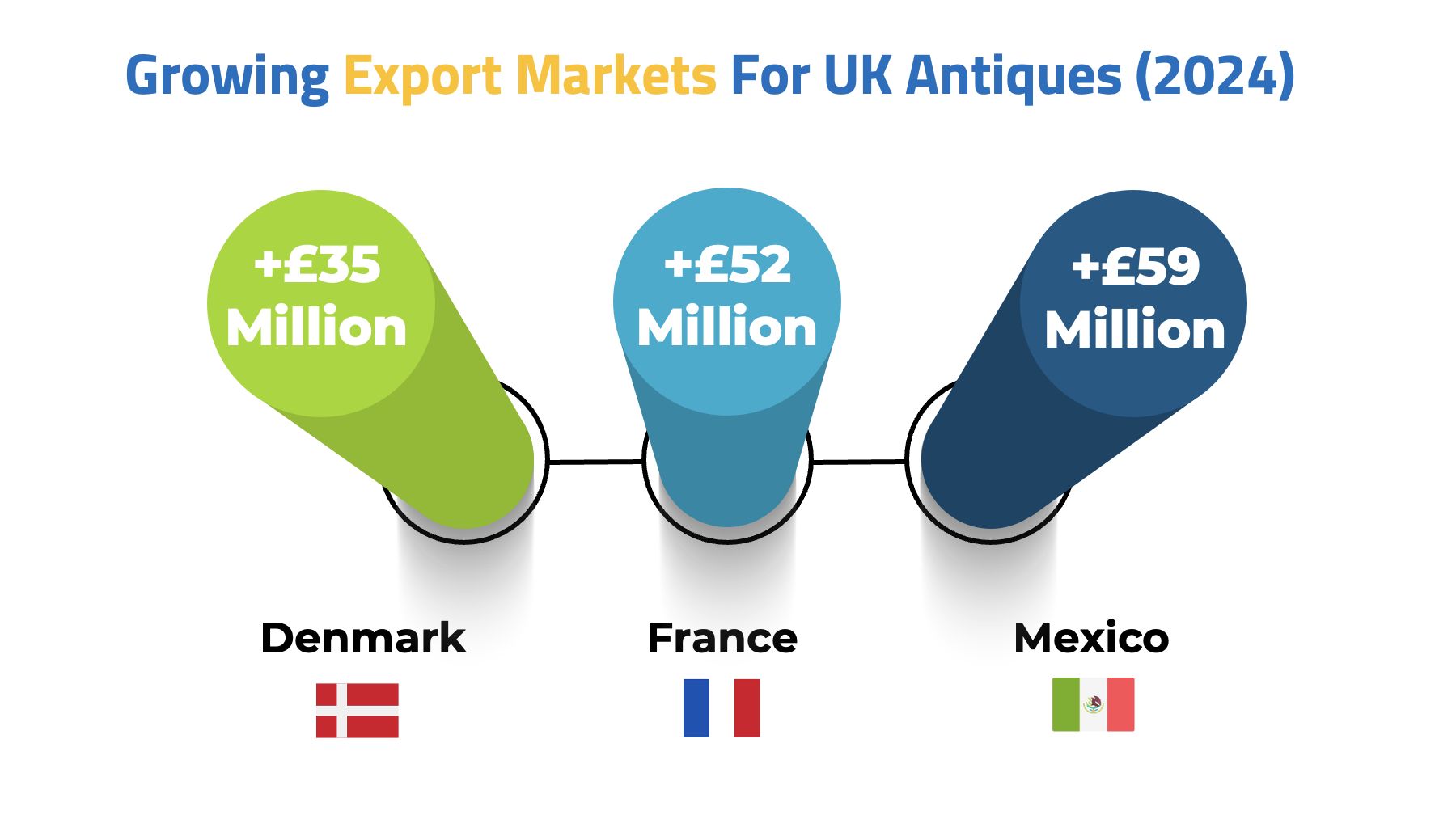

Interestingly, the fastest-growing export markets between 2023 and 2024 were Mexico (+£59M), France (+£52.6M), and Denmark (+£35M), suggesting that dealers are successfully cultivating new and diversifying markets.3

A critical long-term trend that provides context to these figures is the decline in the value of art imports into the UK, which fell from £3.7 billion in 2013 to £2.2 billion in 2022.7 This reduction in the inflow of goods, particularly high-value items for consignment at auction, is linked to the increased costs and administrative burdens of bringing items into the UK, including the imposition of import VAT post-Brexit.9 This trend, when viewed alongside the robust export figures, points to a structural evolution in the market. The UK may be becoming less of a high-value

consignment hub, where international sellers bring major works to London auctions, and more of a dealing hub, where UK-based businesses actively trade their existing inventory to a global clientele. The friction of import VAT may deter a European collector from selling a major painting in London, thus impacting the UK's overall market share figure, but the relative weakness of sterling and the depth of British historic inventory can make it highly attractive for an American designer to purchase a piece of Georgian furniture from a UK dealer, thereby boosting the national trade balance. This indicates that the future health of the UK market may rely less on competing for blockbuster auction lots and more on empowering its thousands of dealers to thrive in the international digital marketplace.

Table 2: UK Art & Antiques Trade Analysis (2024)

| Category | Details | Value / Change | Source(s) |

| Trade Balance | Exports vs. Imports | Positive (£1.42B surplus) | 3 |

| Top 5 Export Destinations | 1. United States | £1.33 Billion | 3 |

| 2. Switzerland | £508 Million | 3 | |

| 3. France | £406 Million | 3 | |

| 4. Germany | £201 Million | 3 | |

| 5. Hong Kong | £165 Million | 3 | |

| Top 5 Import Origins | 1. United States | £888 Million | 3 |

| 2. France | £277 Million | 3 | |

| 3. Switzerland | £257 Million | 3 | |

| 4. Germany | £199 Million | 3 | |

| 5. Netherlands | £109 Million | 3 | |

| Fastest-Growing Export Markets | 1. Mexico | +£59 Million | 3 |

| (2023-2024 Growth) | 2. France | +£52.6 Million | 3 |

| 3. Denmark | +£35 Million | 3 | |

| Fastest-Growing Import Origins | 1. United States | +£271 Million | 3 |

| (2023-2024 Growth) | 2. Germany | +£93.7 Million | 3 |

| 3. Switzerland | +£52.1 Million | 3 |

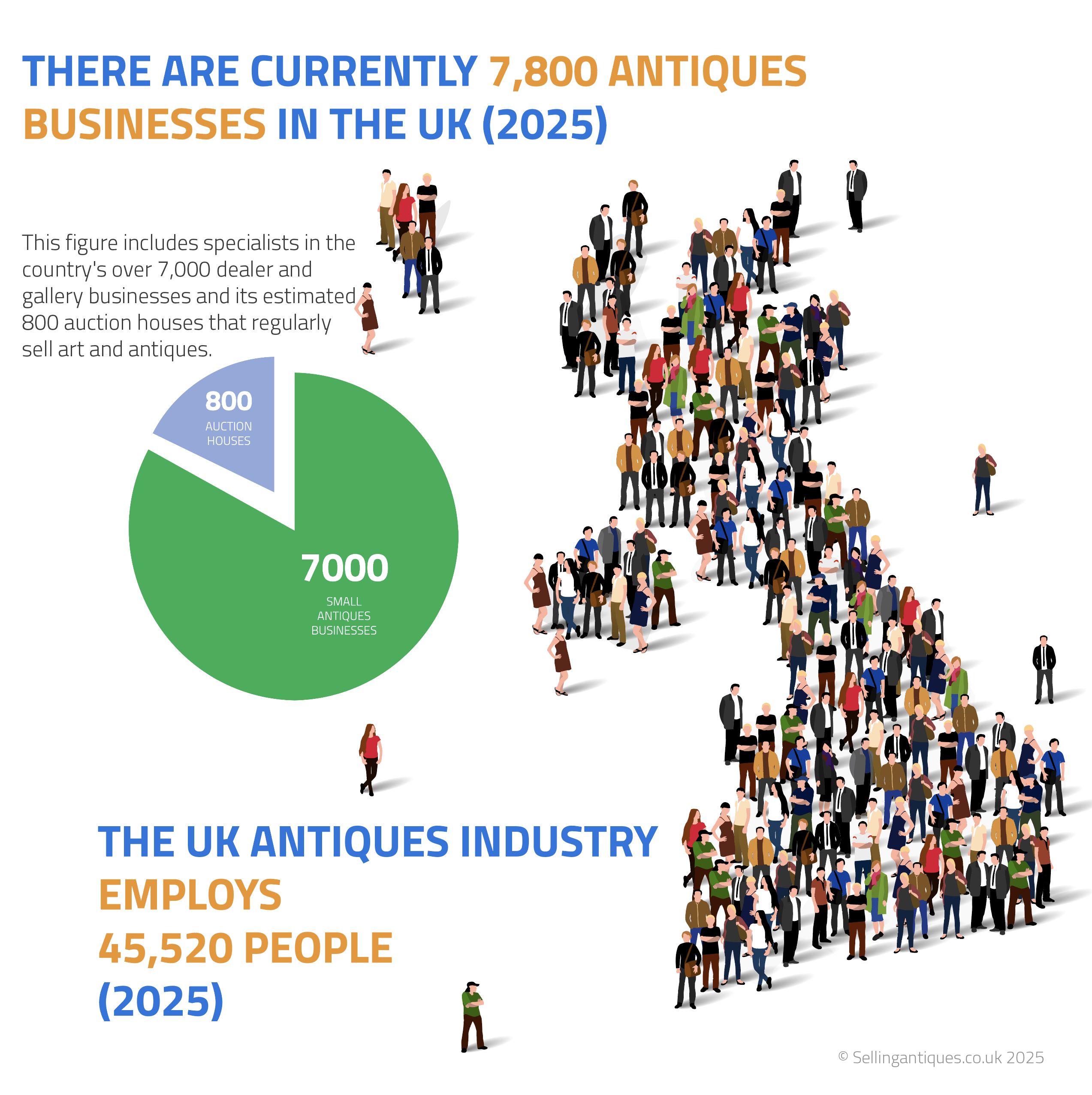

The art and antiques market is a significant contributor to the UK economy, extending far beyond the sale value of its goods. The sector is comprised of approximately 7,800 businesses, which collectively provide direct employment for 45,520 people.7 This figure includes specialists in the country's over 7,000 dealer and gallery businesses and its estimated 800 auction houses that regularly sell art and antiques.7

The market's economic impact creates a substantial ripple effect. In 2022, the sector spent an estimated £3.2 billion (£2.6 billion) on a wide range of ancillary services, supporting a further 37,900 jobs.7 These roles include highly skilled craftspeople such as restorers, conservators, and framers, as well as professionals in logistics, shipping, insurance, and marketing, many of whom are dependent on the art market for their livelihoods.

The fiscal contribution of the market is also considerable. The direct tax revenue generated by the art market is estimated at £1.6 billion, with income tax and national insurance contributions being the largest components. When the tax contribution from ancillary industries is included, this figure rises by at least another £1.1 billion.7 This data provides a powerful argument for the industry's economic importance, particularly when engaging with policymakers on issues of regulation and support.

The value of the antiques market is ultimately determined by what people want to buy and why. In recent years, a powerful and decisive trend has emerged, shifting tastes away from traditional, formal antiques towards more eclectic, design-led, and characterful pieces from the 20th century. This shift is not merely stylistic; it reflects a deeper change in consumer values, driven by the influence of interior design, a desire for individuality, and a growing consciousness around sustainability.

There is a clear market consensus that the most dynamic area of collecting is focused on the 20th century. Mid-century design and Scandinavian modernism are poised to "take centre stage," with iconic names such as Eames, G Plan, and Ercol remaining in consistently high demand.10 This preference is visible in the stock of online marketplaces, where Mid-century sideboards, Danish chairs, and G Plan furniture feature prominently as desirable items.11

The trend extends beyond the 1950s, with a steady resurgence in styles from the 1960s, 70s, and 80s.10 This aesthetic is characterised by curved furniture, such as Serpentine sofas and De Sede Snake sofas, and a focus on materials like chrome.10 This is not a fleeting fashion but a long-term evolution. The minimalist trends of the early 2000s, dominated by retailers like Ikea, gave way in the Noughties to a fascination with the "lean, spiky-legged pieces" of mid-century modern, and the current market represents a more sophisticated and diverse exploration of this entire post-war period.12

The focus on creating unique interiors has elevated the importance of decorative arts and lighting.

Lighting as Sculpture: Elaborate, sculptural lighting has become a key trend, with collectors seeking statement pieces that can define a room. Highly anticipated items include Murano glass pendants and chandeliers, Noguchi paper lamps, and avant-garde luminaires by designers like Ingo Maurer.10 There is also renewed interest in the experimental designs of the Arts and Crafts movement, such as those by W.A.S. Benson, which are favoured for their artistic forms.12

Craft and Natural Materials: A renewed appreciation for craftsmanship, natural materials, and the "harmony with nature" is driving demand for Arts and Crafts furniture, which was itself a reaction against mass production.12 This is also reflected in the continued popularity of studio pottery by masters like Hans Coper, Bernard Leach, and Lucie Rie.10 This trend connects directly to the broader theme of sustainability.

Textiles as Art: Influential interior designers have popularised the use of antique textiles as wall hangings and decorative art. This has driven sales of fabrics like ikats and suzanis from Uzbekistan, and particularly West African Kente cloth, which is prized for its intricate weaves and graphic motifs.12

Colour and Texture: The prevailing aesthetic has moved decisively away from the cool greys and stark whites of minimalism. Instead, palettes of soft, earthy tones like chocolate brown, rust, and olive green are in favour, often accented with retro colours like mustard yellow.10 Rich woods such as mahogany, rosewood, and walnut are being celebrated for their natural patina, with designers encouraging clients to embrace the original brown tones rather than painting over them.14 Playful embellishments like tassels and fringe are also making a comeback.14

Nostalgia-Driven Collectibles: A niche but growing market exists for vintage toys from the 1960s through the 1990s. This demand is driven by nostalgia, with collectors seeking items they remember from their youth. Star Wars collectibles are among the most desired items in this category.10

These dominant trends are not just about aesthetics; they represent a fundamental shift in values. The popularity of Mid-Century, Arts & Crafts, and unique decorative items is a direct reaction against the homogenous, disposable "fast fashion" culture that has permeated retail, including home furnishings.13 Consumers are actively seeking items that embody sustainability, individuality, and a tangible connection to history. The antiques market is therefore no longer just selling "old things"; it is selling authenticity and character. This is a powerful narrative that resonates strongly with contemporary consumer psychology and provides a strategic path for dealers to differentiate themselves from the mass market by focusing on the story and values embedded in their stock.

The interior design profession acts as a powerful engine for the antiques market, shaping trends and driving demand for specific categories. The dominant design philosophy of "mixing old and new" has been instrumental in making antiques more accessible and desirable for a broader audience.14 By incorporating a vintage or antique piece into a contemporary setting, a designer can add character, depth, and a unique story that cannot be replicated with new items. This approach removes the pressure for a client to commit to a fully period-specific look, instead positioning antiques as versatile tools for creating personalised spaces.

This influence is seen in specific trends. For example, the move in kitchen design away from glossy, fitted cabinetry towards a more "unfitted" look has directly boosted demand for functional antiques such as armoires, sideboards, dressers, and refectory tables.12 These pieces are valued for their craftsmanship and the desirable patina they have acquired over time.

Media and events are critical in disseminating these trends. Magazines like Homes & Antiques and events such as The Decorative Antiques & Textiles Fair serve as key barometers, where the tastes of leading designers are showcased and emerging trends can be spotted.12 Conversely, television programmes have had a mixed impact. While some have raised the profile of the industry and sparked interest in antique hunting, others have been criticised for promoting a superficial, "profit-chasing mindset" that misrepresents the trade and focuses on bargains over appreciation.13

The profile of the antiques buyer is evolving. The traditional base of middle-class collectors has been significantly eroded by long-term economic pressures. For many, discretionary income that might once have been spent on art or antiques is now being diverted to more pressing needs, such as helping children get onto the housing ladder.19 High inflation has further squeezed real disposable incomes, impacting spending on non-essential goods.20

Despite these pressures, there are signs of resilience. Recent research indicates a rise in non-essential spending, with 25% of consumers choosing to spend on home improvements, creating a clear opportunity for the antiques market to capture a share of this expenditure.21

A distinct generational divide is apparent in spending habits and motivations. Older generations are more likely to focus their disposable income on experiences such as travel.23 In contrast, younger consumers, particularly

Millennials and Gen Z, are leading the demand for sustainable and unique items.16 This demographic is more inclined to shop secondhand, driven by a combination of economic factors and a conscious rejection of throwaway culture.

For these new buyers, the motivation for acquiring an antique is different. It is less about building a formal, investment-grade collection and more about finding unique pieces with character and a story to tell.16 The appeal lies in owning something sustainable, well-crafted, and individual. This values-driven approach explains why the market can show resilience even when incomes are under pressure; a consumer may forgo a generic new item but be willing to invest in a vintage piece that aligns with their sense of identity and environmental consciousness.

The structure of the antiques trade has been fundamentally reshaped over the past two decades. The rise of digital platforms has disrupted traditional business models, creating a dynamic and often complex marketplace where online and physical channels coexist, compete, and increasingly, converge. Understanding the strengths, weaknesses, and strategic opportunities of each channel is critical for any market participant.

The internet has been the single most transformative force in the modern antiques trade, creating a global marketplace that is accessible to anyone with an internet connection.13 In the UK, a host of specialised online marketplaces have emerged, catering specifically to the antiques and vintage sector. Prominent platforms include

Sellingantiques.co.uk (and its more affordable offshoot, SellingantiquesLITe.co.uk), Vinterior, which brands itself on sustainability, the curated Decorative Collective, and the broad-based Antiques.co.uk.4

These platforms offer an immense scale of inventory. Sellingantiques.co.uk, for example, lists over 70,000 items from UK dealers, with a total value exceeding £140 million.4 This digital shift, accelerated by the COVID-19 pandemic which forced many dealers online for the first time, presents both significant opportunities and challenges.29

For dealers, the primary advantages are reduced overheads—eliminating the need for expensive physical shops with high rents and rates—and access to a global customer base, far beyond their local geography.13 However, this comes with drawbacks. The digital space is intensely competitive, with established dealers competing against a growing number of private sellers and part-time enthusiasts.13 This can lead to price compression and makes it difficult for quality to stand out. Furthermore, the transactional nature of online sales can lead to a loss of the direct, trust-building relationships that were the hallmark of the traditional trade.18

For consumers, online marketplaces offer unparalleled choice, convenience, and the ability to compare prices easily.29 The main risk lies in the inability to physically inspect an item before purchase. This is compounded by the prevalence of inaccurate descriptions and distorted valuations from non-expert sellers, creating an environment where trust is a major concern and the sheer volume of listings can be overwhelming for a novice buyer.18

Despite the inexorable rise of e-commerce, physical retail channels remain a vital part of the market's ecosystem. High street shops and multi-dealer antique centres provide the irreplaceable tangible experience of seeing, touching, and assessing an item in person.18 They also facilitate the development of trust and rapport between a buyer and a knowledgeable dealer, who can provide context, history, and reassurance—qualities often absent online.

However, the traditional antique shop model is under pressure. High rents and business rates have forced many dealers out of standalone premises and into either multi-dealer centres or online-only operations.18 The landscape of physical retail has therefore consolidated, with destinations like London's Portobello Road or historic towns known for their antique shops, such as Lewes, becoming key hubs.24

Auction houses, particularly the major players like Christie's and Sotheby's, continue to dominate the high-value end of the market.30 The internet has also transformed their operations. Even the smallest country auction rooms now have an online bidding platform, dramatically changing their buyer profile from being predominantly local trade to a global mix of dealers, designers, and private individuals.18 This has increased competition for stock and altered the price discovery mechanism for the entire trade.

Antiques fairs are a cornerstone of the UK trade, serving as critical cultural and commercial events that set the rhythm of the dealer's year.31 The UK hosts a rich and diverse calendar of fairs, ranging from enormous, town-sized showground events like those at Newark and other iacf-run venues, to prestigious, meticulously vetted fairs in London such as the LAPADA Art & Antiques Fair, and popular, design-led regional fairs in cities like Bath and the Cotswolds.17

These events are crucial for sourcing new stock, making sales, networking with peers, and connecting with a broad spectrum of buyers, from interior designers to serious private collectors.17 They are often the place where new trends are spotted and solidified.

However, the fair model is facing immense strain. The escalating costs of exhibiting—with reports of spikes over 30% since 2019—combined with the logistical complexities and increased costs associated with Brexit, have created a "perfect storm".34 This has led to the high-profile cancellation of major, long-standing fairs, including Masterpiece London and the Art & Antiques Fair Olympia, sending shockwaves through the industry.34 The decline in participation from European dealers, deterred by the new administrative hurdles, was a key factor in these closures.35

The evolution of these channels is leading to the emergence of a "hybrid" dealer model. In this model, a physical presence—whether a small showroom or a stand at key fairs—is used strategically to build brand identity, establish trust, and allow clients to see the quality of the stock firsthand. The online presence, through a professional website and curated marketplace listings, is then used for marketing, scale, and transactional efficiency. The two channels are becoming symbiotic. This suggests a future with fewer large, multi-room antique shops but a continued demand for high-quality, curated spaces and impactful stands at the most important fairs, which serve as vital physical touchpoints for what are becoming primarily digitally-driven businesses. The high cost and logistical burden of fairs mean that for a dealer whose business is now 80% online, the return on investment for exhibiting must be exceptionally high and clearly justifiable.

Table 3: Comparative Analysis of Sales Channels in the UK Antiques Market

| Online Marketplace | Physical Dealer/Gallery | Auction House | Antiques Fair | |

| Key Strengths | Global Reach, Lower Overheads, 24/7 Accessibility | Curation, Trust, Tangible Experience, Relationship Building | Price Discovery, Access to Fresh Stock, Global Bidding | Networking, Sourcing, Trend Spotting, Direct Sales |

| Key Weaknesses | Lack of Tangibility, High Competition, Trust Deficit | High Overheads (Rent/Rates), Limited Geographic Reach | Buyer's & Seller's Premiums, Less Control Over Price | High Exhibiting Costs, Intense Logistics, Short Duration |

| Typical Buyer | Global, Price-Sensitive, Niche Collector | Local, Relationship-Focused, High-End Collector, Designer | Investor, Collector, Trade Buyer | Trade Buyer, Interior Designer, Serious Collector |

| Primary Challenge | Market Saturation, Inaccurate Listings, Building Trust | Driving Footfall, Competing with Online Prices | Sourcing High-Quality Consignments, Margin Pressure | Spiraling Exhibitor Costs, Declining International Participation |

| Key Opportunity | Niche Curation, Content Marketing, Building a Brand | Hybrid Online/Offline Model, Offering Expert Services | Growth in Private Sales, Themed Online Auctions | Specialist/Themed Events, Enhancing the Visitor Experience |

The UK antiques market, despite its resilience and dynamism, is contending with a formidable set of challenges. These headwinds are political, regulatory, and economic in nature, and they combine to create a difficult operating environment that tests the viability of businesses across the sector.

The UK's departure from the European Union has had a profound and largely negative impact on the art and antiques trade, creating new barriers where none previously existed. The consequences are felt across logistics, costs, and international competitiveness.

Increased Costs & Red Tape: The end of frictionless trade with the EU has introduced significant new costs and administrative burdens. Dealers now face import VAT on goods arriving from the EU, which was not previously the case. This, combined with higher shipping fees and the need for complex customs declarations (such as the C88 form), can result in logistical costs that are more than four times higher than before.35 This administrative load disproportionately affects smaller dealers who may lack the resources or in-house expertise to navigate the new bureaucracy efficiently.36

Impact on Fairs and International Participation: The added costs and complications are a direct cause of declining participation from European dealers and collectors at UK fairs. This was cited as a key contributing factor in the cancellation of major events like Masterpiece London.34 With fewer European exhibitors and less incentive for EU-based collectors to visit, the international character and commercial viability of London's top fairs have been eroded.35

Decline in Market Competitiveness: The new trade friction has directly contributed to the UK's volatile global market share and the marked decline in art imports.9 London is perceived as a more complicated and expensive place to do business compared to its pre-Brexit status as the seamless gateway to Europe. As a result, major auction houses have noted a "drop-off" in consignments from the EU to their London salerooms.35

Unrealised "Brexit Dividends": Many in the trade had hoped that leaving the EU would provide an opportunity to scrap or reform regulations perceived as burdensome, such as the Artist's Resale Right (ARR) and the system of import VAT on art.36 However, these regulations have been retained in UK law. This has left the market bearing the full costs and complexities of Brexit without reaping any of the potential competitive benefits from deregulation, creating what some see as the worst of both worlds.9 The government has made pledges to streamline some import processes, but fundamental changes have yet to materialise.34

Table 4: Brexit Impact Scorecard on the UK Art & Antiques Market

| Area of Impact | Pre-Brexit Environment | Post-Brexit Reality | Industry Outlook/Response |

| Import/Export Costs | No VAT on EU trade. Lower, stable shipping fees. | 5% import VAT on art from EU. Shipping costs up to 4x higher. | Lobbying to remove import VAT. Factoring new costs into pricing. |

| Logistics & Admin | Frictionless trade within EU single market. No customs declarations for EU trade. | C88 customs declarations required. Increased paperwork and need for customs agents. | Investing in customs expertise. Smaller dealers disproportionately burdened. |

| Global Market Share | Stable position, typically ~21% of global market. | Volatile share, fluctuating between 17-18%. | Increased competition from US and China. Focus on non-EU export markets. |

| Art Fair Viability | High participation from EU dealers and collectors. | Sharp decline in EU participation. A key factor in fair cancellations (e.g., Masterpiece). | Fairs closing or adapting. Increased focus on domestic audience. |

| Competitiveness | London as the primary, seamless gateway to the European art market. | London as a "third country" with significant trade friction with the EU. | Calls for deregulation to create a "freeport" effect. Loss of some EU consignments to Paris. |

Alongside the challenges of Brexit, dealers are facing an increasing regulatory burden related to the provenance of their items and compliance with anti-money laundering laws.

Provenance and Export Licensing: While UK law does not have a blanket requirement for provenance on all antiques, it has become a critical and often challenging issue for exporters. Arts Council England, which manages the export licensing system, frequently requests provenance information for three main reasons: to prove an object was imported into the UK within the last 50 years (exempting it from certain controls); to properly assess an object against the "Waverley criteria" to determine if it is a national treasure that should be prevented from leaving the country; and to ensure the object is not an illicitly traded cultural property, for example from a conflict zone.37 The practical challenge is that complete, documented provenance is rare for many historical items, and such gaps, while often innocent, can create significant administrative delays and hurdles for legitimate exporters.37

Authentication Challenges: Authenticating antiques is a complex and scientifically rigorous discipline, combining traditional connoisseurship with advanced techniques like chemical analysis of materials.38 The financial incentive for fraud is substantial, and sophisticated forgeries, sometimes using historically accurate materials and artificial ageing, remain a persistent threat to the market's integrity. Each category, from metalwork and textiles to furniture and books, presents its own unique authentication challenges.38

Anti-Money Laundering (AML) Regulations: The art and antiques market is recognised as being vulnerable to money laundering due to its use of high-value, portable assets, the subjectivity of pricing, and a historical culture of private transactions.39 In response, the UK, following the EU's Anti-Money Laundering Directives (such as 6AMLD), has designated art market participants as "obliged entities." This places a legal requirement on dealers and auctioneers to conduct thorough Customer Due Diligence (CDD), including verifying the identity of clients and the source of their funds, and to file Suspicious Activity Reports (SARs) with the National Crime Agency when necessary.39 This adds a significant compliance burden and cost, and represents a major regulatory divergence from the less-stringently regulated US market.41

Compounding the political and regulatory headwinds are persistent economic and operational pressures that affect the day-to-day viability of antiques businesses.

Cost of Living and Squeezed Incomes: A prolonged period of high inflation has eroded the real disposable income of many UK households, impacting their ability to spend on non-essential items like antiques.20 This has been particularly acute for the traditional middle-market collector base, whose discretionary spending has been curtailed.19

Rising Operational Costs: For dealers maintaining a physical presence, the high costs of commercial rent and business rates are a major challenge and a key reason many have shifted to online-only models.18 For those participating in fairs, the cost of stands has spiralled, making it harder to achieve profitability.34

Sourcing Difficulties: A common complaint among dealers is that sourcing good quality stock is becoming increasingly difficult. The internet has empowered knowledgeable private owners to bypass dealers and sell their items directly through online marketplaces or at auction, reducing the flow of fresh material into the trade.13

Existential Threats: For some businesses, operational challenges can become existential. A poignant example is an antique centre in South Wales facing closure after being flooded three times in five years, leaving it unable to trade or secure insurance, and facing court action over unpaid business rates.42 This illustrates the acute vulnerability of small businesses in the sector to localised, external shocks.

While the UK antiques market faces undeniable headwinds, it also possesses unique strengths and is positioned to capitalise on several powerful, long-term trends. For dealers, auctioneers, and investors who can strategically adapt to the new landscape, significant opportunities exist. The future of the market lies in a deliberate pivot away from a high-volume, commodity-based model towards a more curated, service-oriented approach that emphasises expertise, trust, and the unique values that antiques offer.

The single greatest opportunity for the antiques market is to position itself as a leader in the sustainable, circular economy.

Core Opportunity: Antiques are the epitome of sustainable consumption. They are inherently "green," promoting the principles of reusing, repairing, and reducing waste, thus minimising environmental impact.43 A landmark report found that an antique chest of drawers can have a carbon footprint up to

16 times smaller than a newly manufactured equivalent.43 This is a powerful and quantifiable advantage.

Target Audience: This sustainability narrative resonates strongly with younger, environmentally conscious consumers, particularly Millennials and Gen Z. This demographic is actively turning away from the "fast fashion" model of disposable goods and seeking unique, eco-friendly, and durable options for their homes.16

Strategic Recommendation: The trade must proactively and explicitly market the "green" credentials of antiques. This requires a shift in messaging, moving beyond simple descriptions of age and style to tell a compelling story about sustainability, longevity, and superior craftsmanship. Campaigns like "Antiques Are Green" provide a valuable template 45, and online marketplaces such as Vinterior, which brands itself as the "Home of Sustainable Vintage Furniture," demonstrate the commercial appeal of this approach.11 Dealers should integrate this message into their branding, marketing materials, and client conversations.

While the internet has created challenges of saturation and competition, it remains the most powerful tool for growth if used strategically.

Core Opportunity: Digital channels provide dealers with the ability to build a global brand and access a customer base far beyond the reach of a physical shop.25

The Challenge: The online marketplace is crowded and suffers from a trust deficit, with knowledgeable dealers competing against a sea of amateur sellers.18

Strategic Recommendation: A successful digital strategy requires more than a basic listing on a mass-market platform. Dealers should invest in creating professional, high-quality own-brand websites that serve as a digital flagship. They should leverage social media platforms not just for sales, but for storytelling, sharing expertise, and building a community around their brand. To signal quality and differentiate from the noise, listing on curated, trade-specific platforms like The Decorative Collective or the LAPADA marketplace is essential.27 The ultimate goal is to build a trusted brand and a loyal following, not just to sell an individual item. This reinforces the importance of the hybrid model, where a strong digital presence is authenticated by selective, high-impact physical touchpoints.

The long-term health of the market depends on its ability to engage with the next generation of buyers.

Core Opportunity: Younger buyers are demonstrably interested in the market, but their motivations and price points differ from those of traditional collectors. They value uniqueness, sustainability, self-expression, and the story behind an object.16

The Challenge: This demographic can be intimidated by the formality of traditional antique shops or priced out of a market that often focuses on high-value items.19

Strategic Recommendation: The trade must adapt its offering and its approach. This means placing greater emphasis on the decorative, 20th-century, and "affordable luxury" segments that align with contemporary tastes and budgets. Creating accessible and unintimidating buying experiences is crucial. This can be achieved through clear, transparent online pricing, engaging social media content, and a welcoming atmosphere at fairs and in shops. The model of the Affordable Art Fair, which has successfully demystified art buying for a new audience, offers valuable lessons.17 Dealers should actively demonstrate how vintage pieces can be mixed with modern decor to create a personal and stylish interior, making antiques relevant to contemporary life.

The analysis of the market's challenges and opportunities points towards a fundamental reinvention of the role of the antique dealer. The market is shifting from being a transaction-based commodity market, where value is derived from the object itself, to a curation-based service market, where value is derived from the dealer's expertise. In a world where anyone can list an item online, competing on price is a race to the bottom. The true competitive advantage lies in knowledge, trust, and the ability to provide a seamless, expert-led service.

This transformation suggests the following strategic imperatives:

For Dealers: Embrace the hybrid model and the role of expert curator. Specialise in a niche to become a recognised authority. Invest in professional photography and storytelling to build a compelling brand. Explicitly market the sustainable and unique qualities of your stock. Most importantly, reframe your business as a service: you are not just selling a chair, you are providing a client with a perfectly sourced, authenticated, and delivered piece of design history that meets their specific needs. This may lead to new revenue models, such as charging sourcing or consultation fees.

For Auction Houses: Continue to invest heavily in user-friendly online bidding technology to maximise global reach. Recognise the resilience and growth potential of private sales and dedicate resources to expanding this division.47 Develop a programme of curated, themed sales aimed squarely at younger collectors and the interior design trade, focusing on the high-demand categories identified in this report.

For Investors and New Entrants: The most significant opportunities may lie not in traditional dealing but in building the infrastructure that the new market needs. This includes developing better digital platforms that solve the critical problems of trust, curation, and logistics in the online space. There is also a clear and growing need for high-quality, specialist restoration and conservation services to support the circular economy by extending the life of antique and vintage items.43

For the Industry as a Whole: A unified, persistent, and data-driven lobbying effort is essential to mitigate the burdens of Brexit and advocate for a more supportive regulatory environment. Presenting a clear case for the market's substantial economic and cultural importance, using data on employment and fiscal contributions, is the most effective way to engage with policymakers and secure the future of this vital British industry.7

Thank you.

Your comment has been sent to Sellingantiques.